Motor Insurance

Building AngelOne's First Insurance Product

My Role

Lead Product Designer with a supporting role in UI Design

Team

Cross-functional collaboration

with UI Designer and AngelOne's Product & Development teams

Timeline:

January 2024 – November 2024

Disrupting the Insurance Space

Designing an intuitive journey for 25M+ users to choose insurance with confidence.

To craft an engaging and seamless digital motor insurance experience, empowering users to protect their vehicles with confidence while laying the groundwork for expanding AngelOne’s insurance offerings to include life and health coverage.

Exploring the Motor Insurance Landscape

Examining existing user behavior on the AngelOne platform alongside market data on insurance purchase patterns in India to identify key insights and opportunities.

Market Understanding & User Context

Studied purchase patterns and user demographics

Analyzed distribution channels

Identified key purchase drivers and barriers

Mapped user investment journeys

Pre-Purchase Journey Analysis

Explored user awareness levels

Documented decision-making factors

Identified friction points

Analyzed documentation requirements

Studied quote comparison behavior

Post-Purchase Experience Review

Investigated policy management needs

Analyzed claims processes

Evaluated network garage accessibility

Assessed support channel preferences

Mapped digital vs. physical touchpoint preferences

Benchmarking Against Competitors

Evaluated six major players in the Indian insurance market across key parameters

Survey with 620 Angelone employees

We analyzed their decision-making process, preferences, and key factors influencing their choice of motor insurance type, provider, and distribution channel.

Decision -Making Factors

🔹 Distribution Channel – Fast, easy, and cost-driven choices.

🔹 Brand/Company – Claim settlement ratio, past experiences, and lowest price.

🔹 Policy Type:

First-party – Coverage over price, financial security, risk aversion.

Third-party – Price-sensitive, legal compliance, minimal engagement

Insurance Renewal Trends

🔹 Majority Renewed: Many users have renewed their insurance.

🔹 New Insurance Buyers: Some purchased their first policy with their car.

🔹 No Insurance: A small group lacks insurance despite legal mandates.

Purchase Channels

🔹 Online Marketplaces – Most popular choice due to speed, ease, and affordability.

🔹 Car Dealerships – Second most common; trusted due to familiarity & past experiences.

Brand Preferences

🔹 Top 3 Brands Chosen: ICICI, Bajaj, and TATA.

🔹 Reasons for Preference:

Strong claim settlement ratios.

Established brand trust.

Peer recommendations.

Knowing Our Users Better

25 existing users were interviewed from Tier 2 & 3 cities to gain insights into their pain points and insurance needs.

Predominant part of the user group:

Tier 2 & 3 City Residents in India

🔹

Economic Segment: Lower middle-class individuals.

🔹

Occupations: Private jobs, government roles, or small businesses

🔹

Financial Mindset:

Price-sensitive, looking for value-driven policies

🔹

Digital Behavior: Comfortable with mobile apps but need guided experiences

Other User Archetypes

Insurance Explorers

Users new to motor insurance or exploring options, focused on understanding and making informed decisions.

Purchase-Assisted Users

Users who need additional help or reassurance during the purchase process, whether due to complexity or lack of confidence.

Post-Purchase Managers

Users with existing insurance seeking tools to manage, update, or renew their policies efficiently.

Vehicle Managers

Users seeking a centralized platform for managing vehicle info, insurance, documents, and alerts.

Claim Submitters

Users filing claims for accidents, theft, or damages, needing a smooth and transparent process.

Let’s Begin

Structuring the Experience

Approach 1

Insurance Tab

Help & Support

Call for Expert Assistance

&

Create Ticket

Discover Page

(Motor Insurance Widget)

Enter Registration number

Confirm vehicle and RC details

View Insurance Plans

Select Add-ons

Review Policy

BUY NOW

Vehicle Vault

(Added Vehicle)

1. Vehicle Insurance

2. Traffic Challan

3. PUCC Check

4. Vehicle Docs

4. Add Another Vehicle

My Policies

Track, update & manage policies bought from angel

Approach 2

Insurance Tab

Homepage

Enter Registration number

Confirm vehicle and RC details

(Back to homepage)

Goes to Vehicle Vault

Existing Insurance Status

View Insurance Plans

Review Policy

BUY NOW

(Other features)

1. Insurance Status

2. Traffic Challan

3. PUCC Check

4. Vehicle Documents

5. Support

Approach 3 (Selected)

Insurance Tab

Help & Support

Call for Expert Assistance

&

Create Ticket

Homepage

Enter Registration number

View Insurance Plans

Confirm previous policy details

Review Policy

BUY NOW

(Back to homepage)

Added Vehicle Details

1. Insurance Status

2. Explore all plans

3. Add another vehicle

My Policies

Track, update & manage policies bought from angel

The Product Manager and I explored three approaches. The first two added unnecessary steps before purchase, making the process complex for Tier 2 and 3 users.

We chose Approach 3 as it streamlined the journey—auto-fetching details from the registration number, leading users straight to plan selection for a quick, hassle-free purchase.

Let’s Begin

Enabling users to discover insurance quotes easily

Motor insurance is often seen as complex and transactional. Users, especially first-timers, don't intuitively relate to it like they would with familiar financial products. The design aimed to bridge that gap and simplify discovery.

Design Goals:

Learnability

Discoverability

Simplicity

First-time Onboarding

Trust Building

Reducing Entry Friction

By starting with just a vehicle number, the flow lowers the barrier for new users who might feel unsure about where to begin.

Guiding with Visual Cues

A clean, image-first layout helps users understand the offering quickly without reading-heavy content, making the experience more approachable.

Supporting Unprepared Users

The option “I don’t have my vehicle number handy” adds flexibility, reassuring users and preventing drop-offs at the very first step.

Encouraging Trust Early On

The flow is designed to feel light and comforting—helping users move from hesitation to interest in what I call the developing trust phase.

Measurable Impact

55.16% Click-Through Rate

on the vehicle entry step—demonstrating strong user engagement and a successful reduction in entry friction for first-time users.

Returning user

Re-Engagement for Returning Users

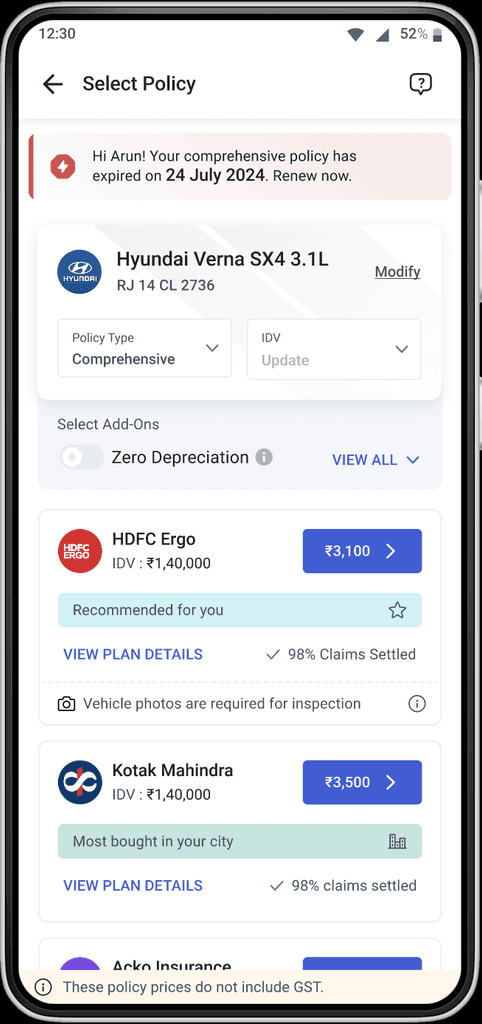

For returning users, the homepage is designed to feel familiar, personal, and action-ready—reducing friction and nudging them toward plan selection or renewal with confidence.

Familiar Context First

By displaying the previously entered vehicle and viewed quote upfront, the experience feels personalized and helps users re-engage quickly.

Creates urgency with clear communication

A smart reminder on policy expiry creates urgency without being intrusive, guiding users toward timely action.

Smart Recommendations

Relevant insurance plans are preloaded based on the user's vehicle, removing guesswork and enabling faster comparison.

Pre Purchase

Personalized Renewal Experience

Built for Tier 2 & 3 Users

Designed flows with simplified language, video assistance, and minimal input effort—addressing the needs of semi-digital users in smaller cities.

Smart Content Hierarchy

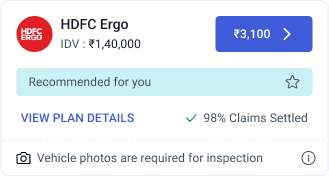

Reordered key data (Insurer > Price > Claim/Network) to match how users prioritize, speeding up selection and improving comprehension.

Boosted Decision Confidence

Introduced credibility tags like “Most bought in your city” and “Recommended for you,” using behavioral data to guide user choices intuitively.

Frictionless User Flow

Auto-filled vehicle and plan data reduced effort, while modular dropdowns and toggles allowed flexible, guided customization.

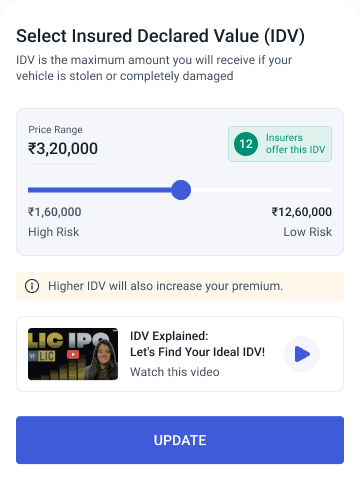

Simplified Decisions with Real-Time Help

Introduced insurer insights, risk indicators, and explainer videos during IDV selection to help users make informed choices and reduce drop-offs.

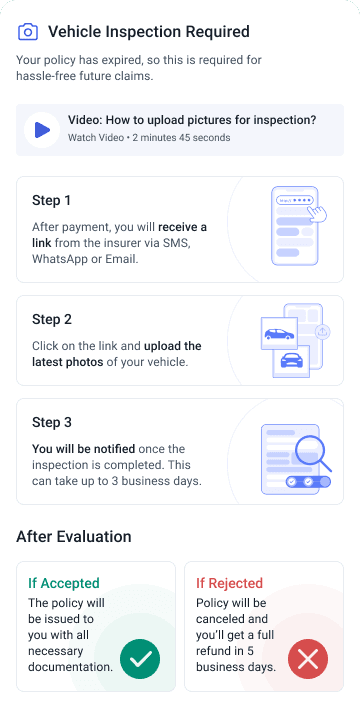

Streamlined Expired Policy Flow

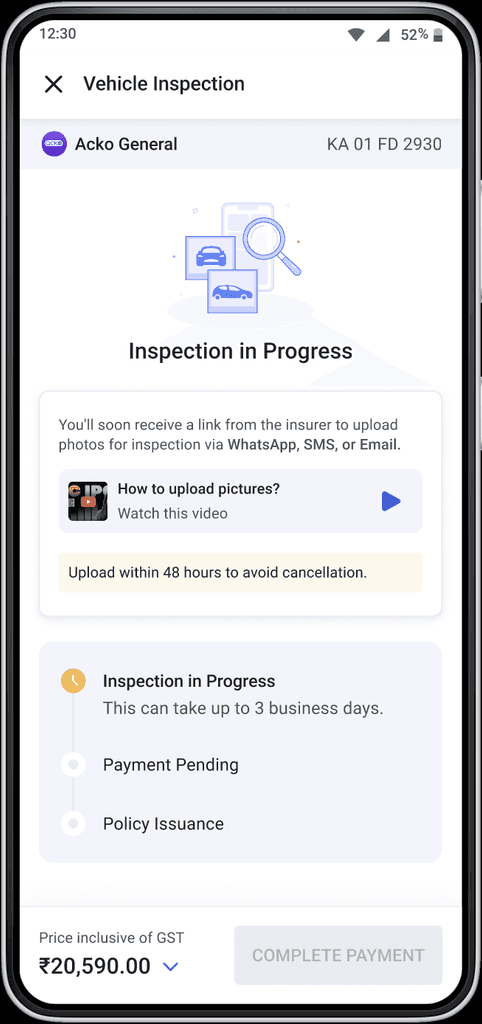

Made vehicle inspection easy post-expiry with a 3-step flow and support video for faster completion.

A/B Tested Tag Labels

Experimented with tag terminology (“Most Bought” vs “Popular in your city”) to improve trust and conversion.

52.5% Quote Exploration Rate

Among users who added their vehicle, over half proceeded to explore renewal quotes—a strong indicator of engagement in a low-intent, post-purchase flow.

Optimizing Post-Quote Interactions for Increased Engagement

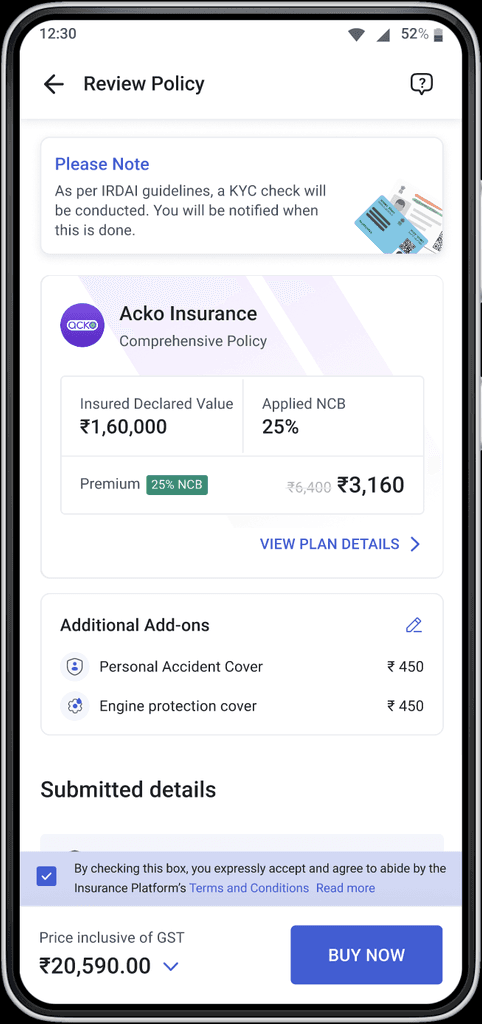

Simplified complex information to aid decision-making and increase purchase confidence.

Guided users through tasks with step-by-step instructions and tutorial videos, reducing friction.

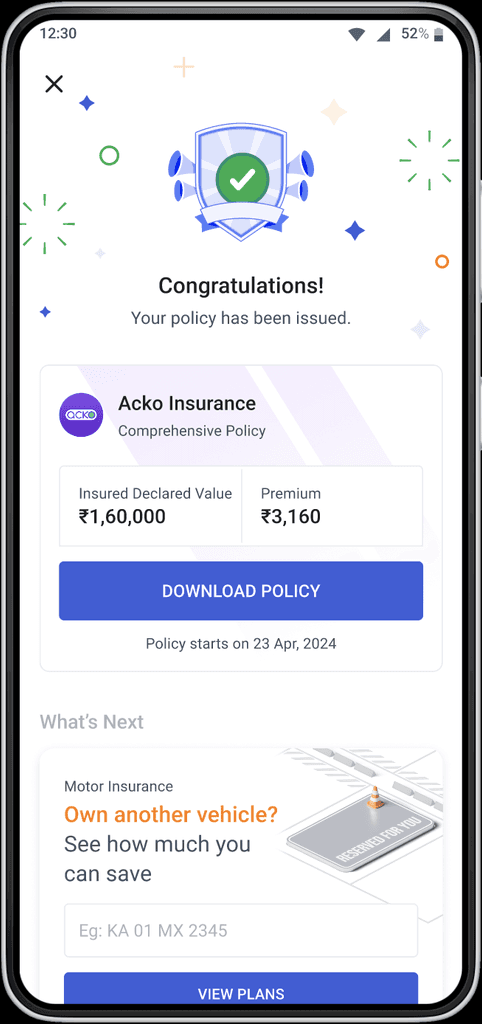

Reinforced trust with positive feedback and encouraged engagement through timely cross-sell opportunities.

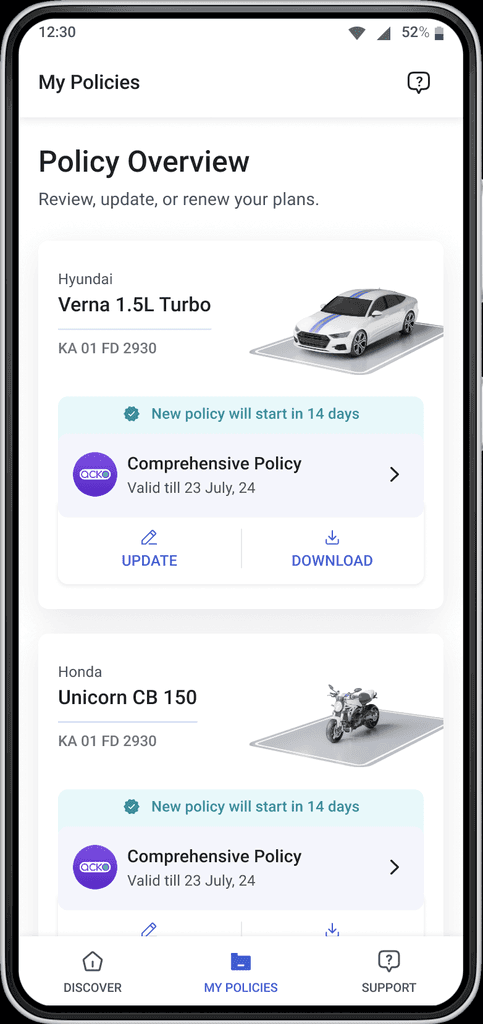

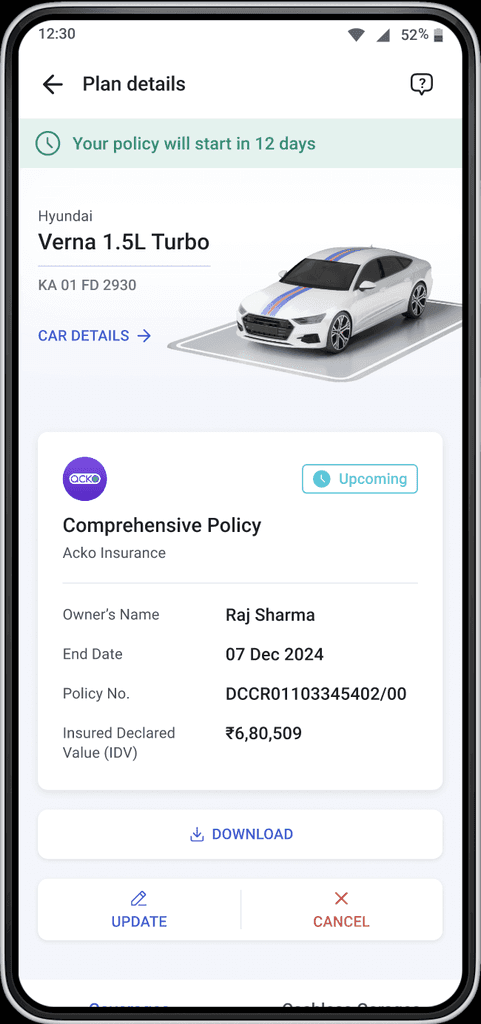

Creating Confidence After Conversion

Elevating the Post-Purchase Experience

Shifted focus from transaction to relationship—creating intuitive tools and timely communication that foster user trust and long-term retention.

Actionable Policy Management

Quick actions like Update, Download, and Cancel give users instant control—driving trust and reducing support reliance.

Proactive Communication

Integrated timely, contextual notifications for policy start dates, expirations, and renewals—ensuring users stay informed without friction or surprises.

Clear Policy Segmentation

Crafted a clean, scrollable layout that segments active and upcoming policies, helping users focus on what matters and reducing overwhelm.

Data-first impact summary

Demonstrating the tangible effects of design decisions on both user experience and business performance.

50%+

of users completed onboarding after giving consent

80%+

engaged with key features post-onboarding

Weekly policy sales remained stable, indicating sustained user interest and product-market fit

Check Next Phase!

Beta-Ready:

Iterating on the MVP

We launched the beta version of our insurance platform to 60,000 users.