Motor Insurance

Beta-Ready:

Iterating on the MVP

My Role

Lead Product Designer

Team

Cross-functional collaboration

with UI Designer and AngelOne's Product & Development teams

Timeline:

December 2024 – Present

Missed the foundation behind it?

Check out Phase 1 for the background

MVP design (Phase 1) was an extensive phase which built Motor Insurance from ground up.

185.7% Growth in Policy Sales Post Beta Launch

We launched the beta version of our insurance platform to 60,000 users. While adoption looked promising, our post-launch analysis uncovered key drop-offs and low engagement across critical user journeys.

This case study outlines how we:

Identified engagement gaps

Iterated on solutions through data-backed design

Uncovered design and behavioral issues

This validated the product-market fit and informed the next phase of rollout.

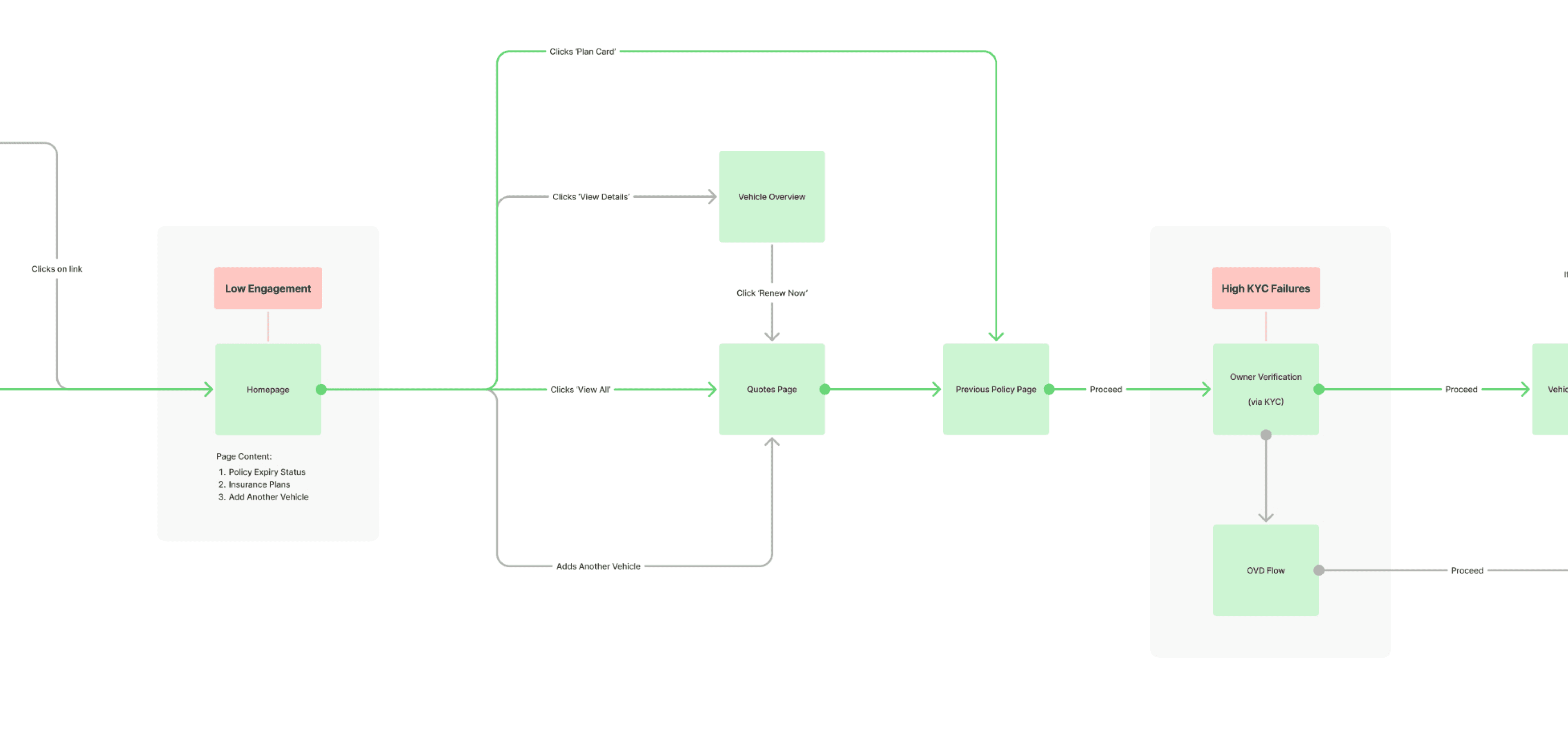

Click the image to view entire user flow

Key Impact Areas

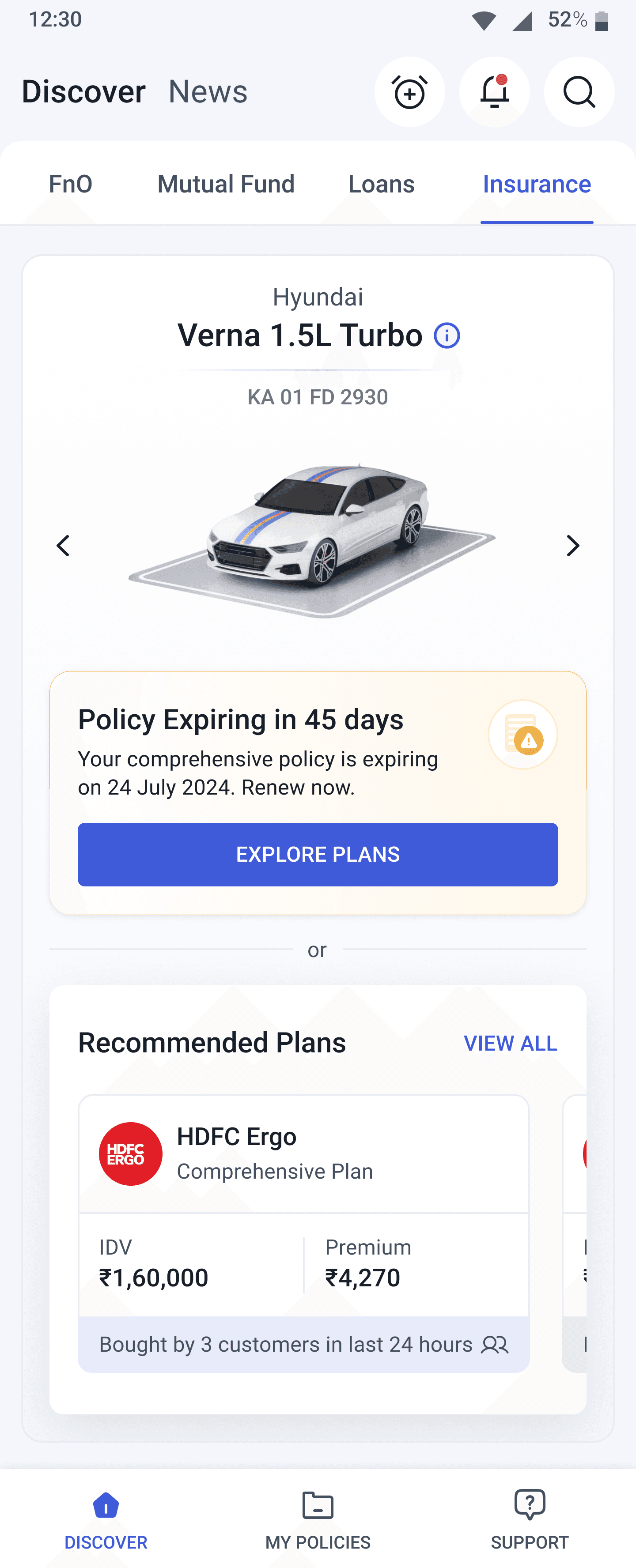

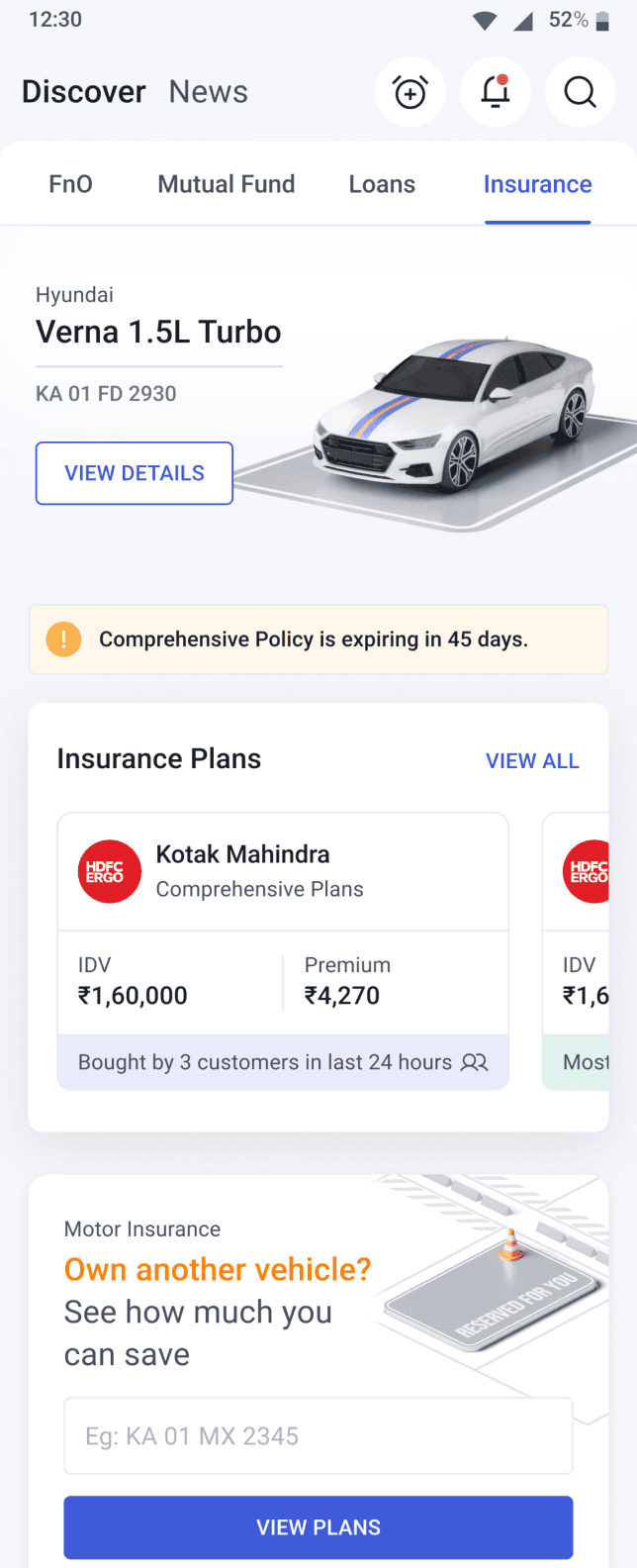

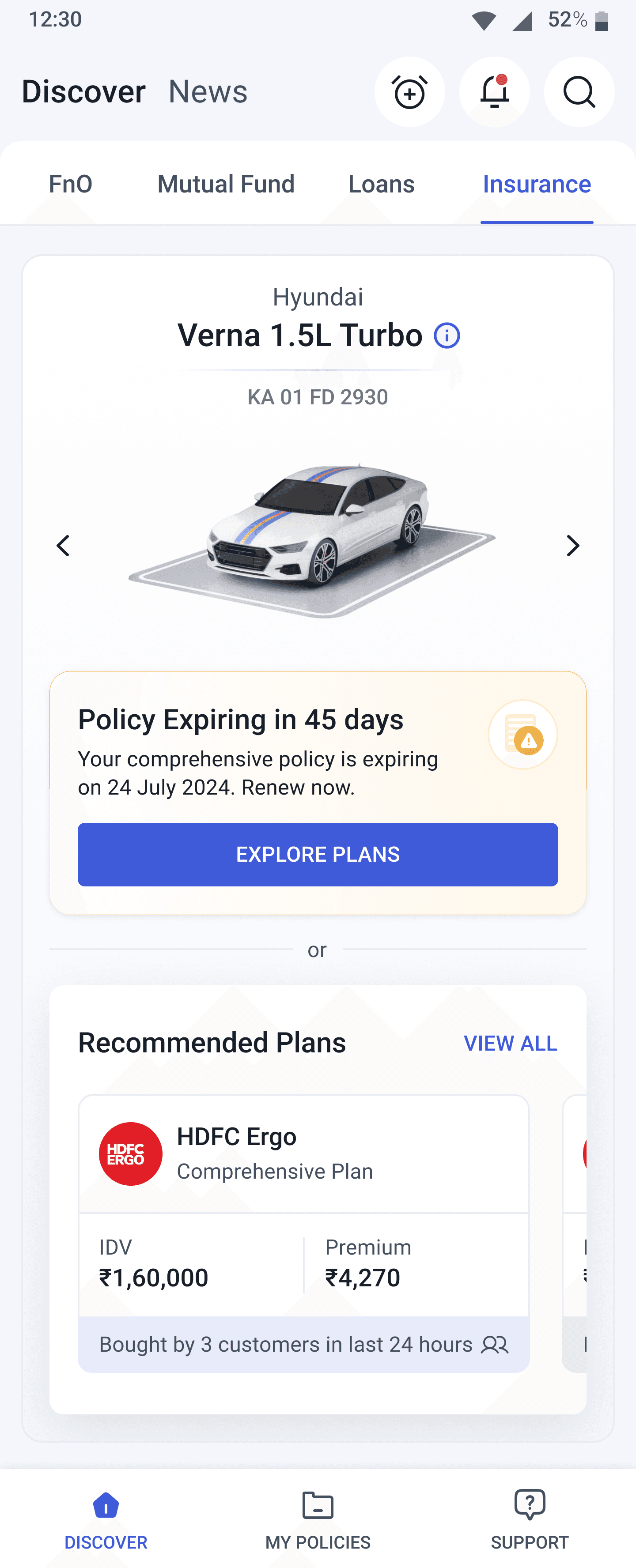

Low Engagement on Homepage

Impact: 113.2% increase in Quote Page visits

Result: Improved content visibility and structure led to more users exploring insurance plans.

KYC Drop-Offs (To be added in detail soon)

Impact: Improved KYC success rate by 38.4%

Result: Targeted flow optimizations and user intervention strategies reduced KYC drop-offs

aaa

Detailed breakdown to be included shortly.

01

Returning Users

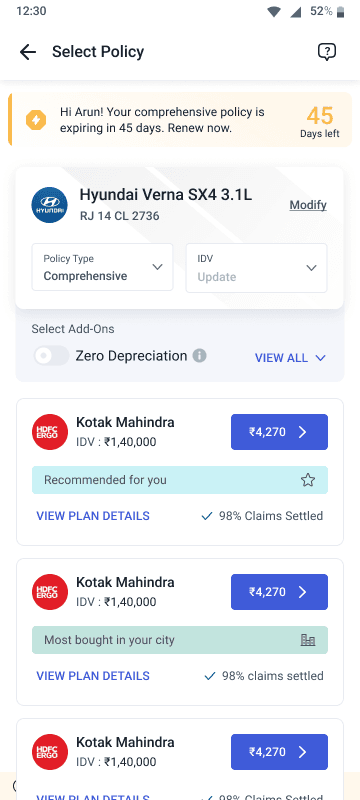

Addressing Low Engagement on Homepage

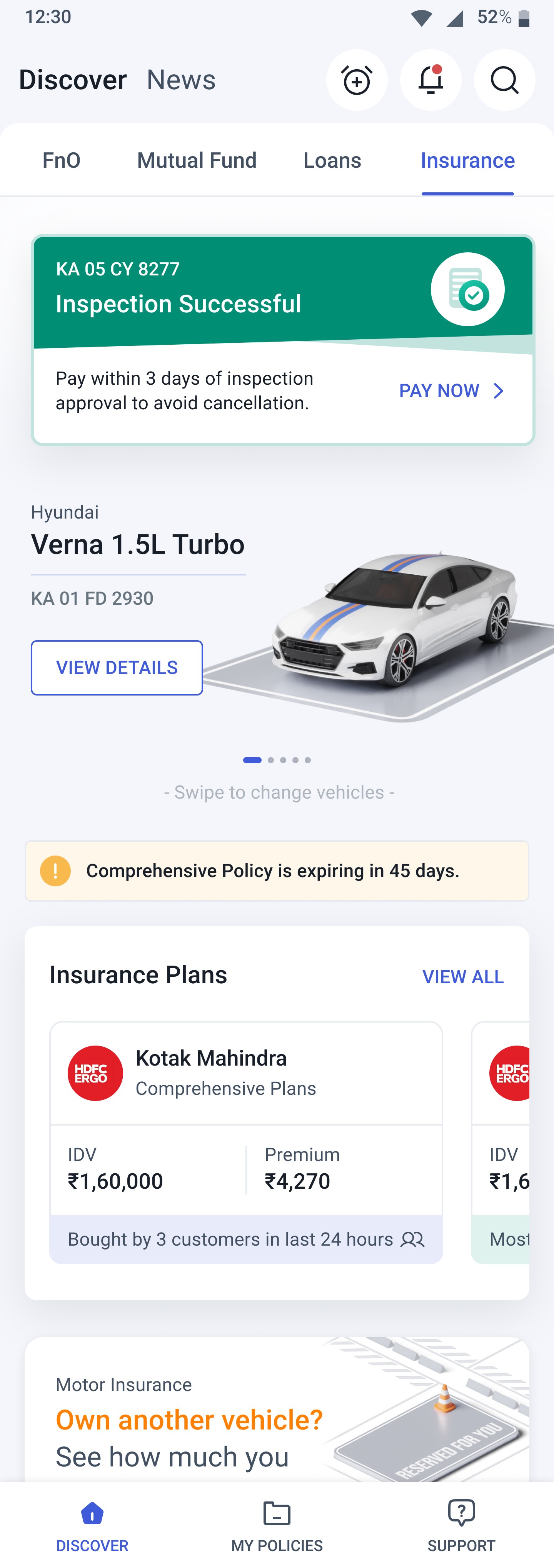

After the beta launch, we saw a notable drop in engagement, especially around our core goal: driving insurance renewals. Key metrics highlighted critical drop-off points across the user journey.

Key Insights

Bounce Rate

56.2%

(Users were leaving without engaging)

CTA Click Rate (View All) Rate

22.7%

(Low interest in exploring plans)

Uncovering Why Users Didn't Engage

User intent:

Renew insurance easily

Not grabbing attention

Low Urgency Perception

Low Visibility, High Drop off

Missed Core Action

Positioning Problem

Low Exploration Rates

Low visual priority

Leads to passive scanning, not active clicking

Visually dominant but disconnected from car context

Perceived as Primary Action

Causes Misguided Clicks

(Opportunity to merge inspection task here)

Top Problems Identified

Lack of Clear Primary Action

Cognitive Overload: Multiple CTAs create confusion instead of guiding users toward one key action.

Lack of Motivating Message

The experience doesn’t create urgency or emotional drive to complete the renewal. It feels optional rather than essential.

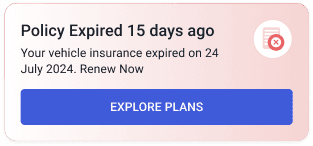

Weak Urgency Triggers

While there's a generic expiry status message, it lacks emotional impact. No FOMO or risk-based prompts are present.

Disconnected Journey

Users coming from reminders or notifications don’t see continuity.

The page fails to acknowledge or reinforce their original intent.

Design Goal

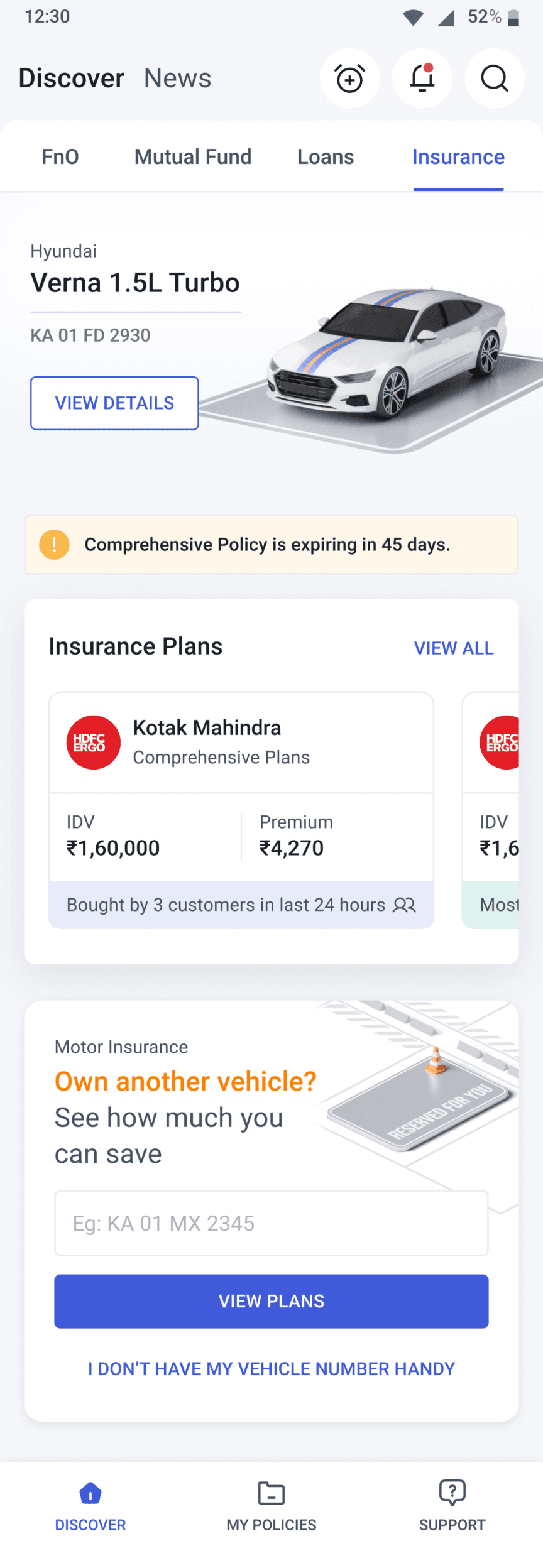

Our goal was to clean up UI/UX friction, make high-priority actions more prominent, and improve the flow for users nearing insurance expiry.

No clear

CTA

Highlight a single action

Faster user decisions

Lack of

Urgency

Add emotional triggers

Increased engagement

Disconnected Journey

Personalize touchpoints

Higher task completion

Weak Visual Priority

Reorganize layout

Reduced

drop-offs

Faster user decisions

Increased engagement

Higher task completion

Reduced

drop-offs

25+ Scenarios Designed

across all stages of the purchase journey adhering to guided flow and visual consistency

Simplified Navigation

Replaces carousel for better clarity and discoverability.

Urgency cue

Prominent expiry to prompt quick action.

Dual entry points

Caters to both proactive users (explore CTA) and casual scrollers (recommendations).

Vehicle details deemphasized

Kept subtle to reduce cognitive load and maintain focus on renewal actions.

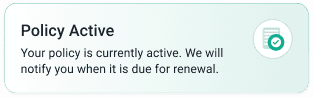

Sticky plan visibility

Keeps plan options visible to boost conversions.

Elevated critical info like vehicle, plan status, and CTAs—reducing scan time and guiding user flow from recognition to action.

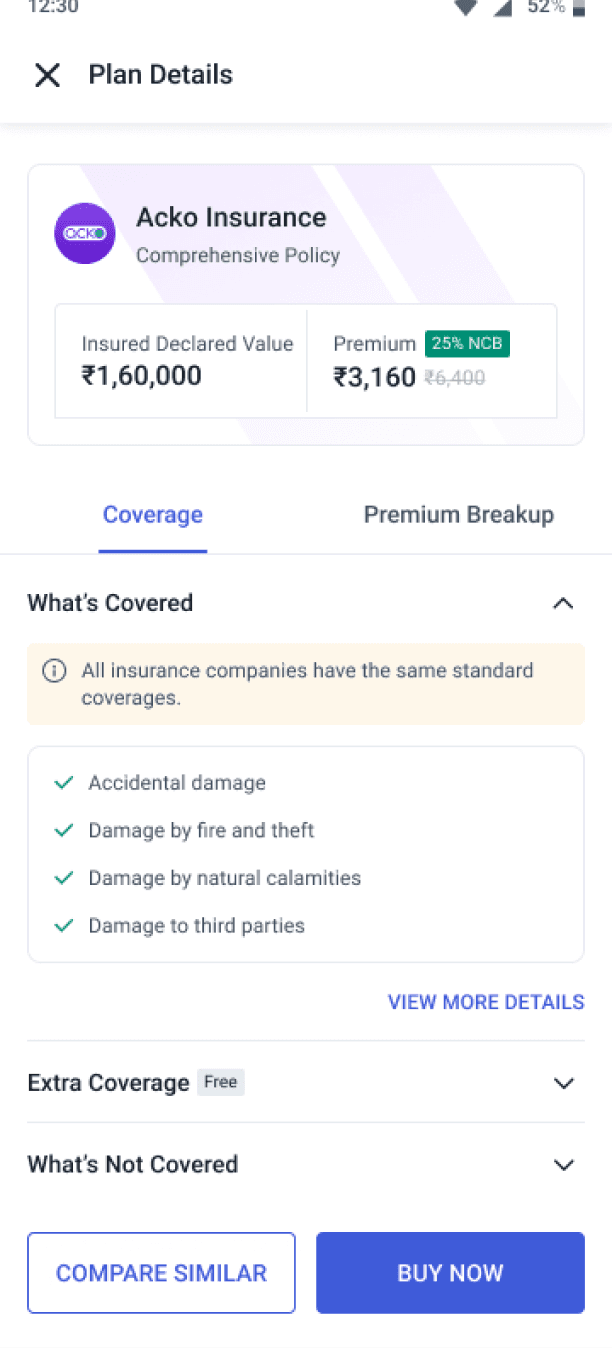

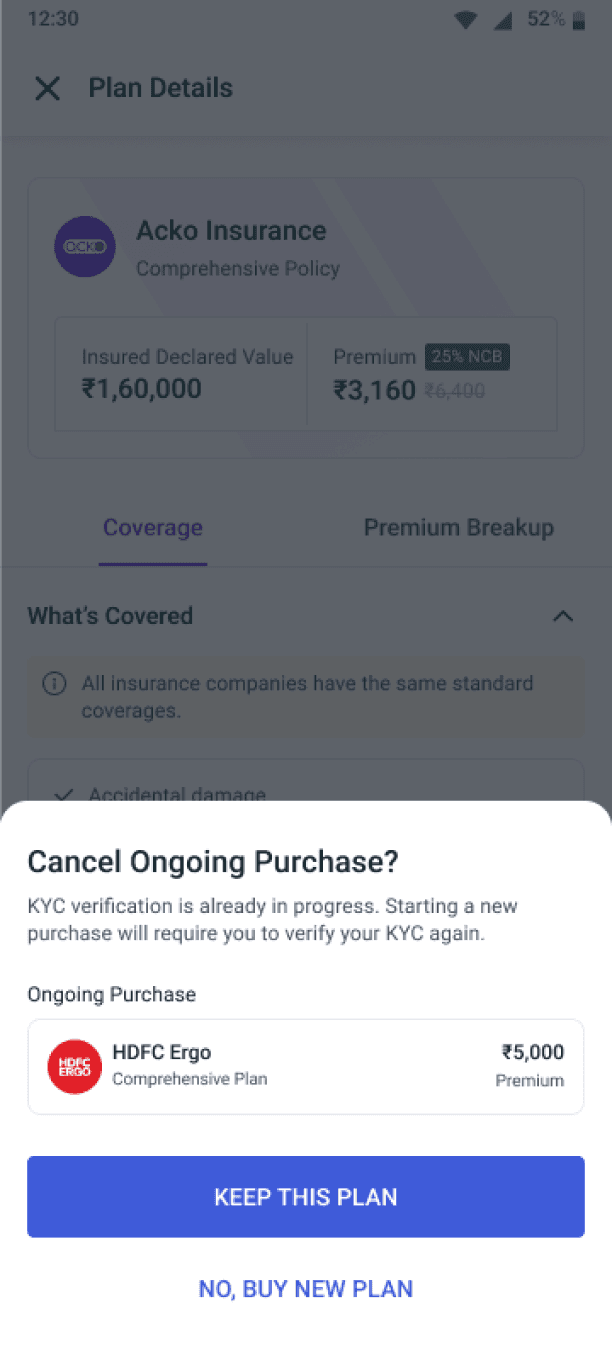

Strategic Friction to Safeguard Ongoing Purchase

Purpose: Prevent accidental drop-offs, compliance issues, and user confusion.

Click “view all”

Click “Plan Card”

Click “Premium CTA”

Click “plan details”

Click “Buy Now”

Contextual Reminder

to prevent unintentional restarts

User Retention

via "Keep This Plan" prompt

Informed Switching

with purchase awareness

Compliance Assurance

by blocking duplicate KYC submissions

Error Prevention

by avoiding data overwrite

Impact of Design Interventions

Boosting Engagement & Conversion with a New CTA Strategy

Explore Plans CTA Addition

Clicked by

46.9%

users post-launch

Strong Engagement validated user curiosity and improved discovery pathways

Impact on Conversion Funnel

Conversion to Quote Page:

From

41.5%

to

88.5%

That is a

+113.2%

relative increase

Driven by clear navigation and added entry points

Old Design

New Design

Check out the previous phase!

Minimal Viable Product

AngelOne's first-ever insurance product caters to 20+ million users, redefining the digital insurance experience.